ATAF Tax Administration Library

The ATAF member's publication platform aims at providing African tax administrations with a platform to showcase and share amongst themselves their good practices, experiences and knowledge in tax matters. The main objective is to allow tax administrations to make available their publications on this platform so that they can preserve, enhance and develop good practices fostering the network among the 38 ATAF member countries. Because there are great institutional strategic and operational variations with regard to tax administration on the continent, the ATAF member's publication platform can assist in identifying good practices in order to address issues including but not limited to the following three broad categories: weak and ineffective domestic tax legislation; difficulties in the tax administration obtaining relevant information; and, implementation gap due to limited capacity in tax administrations to apply the tax rules and use the information they are able to obtain. The performance of a particular tax administration can be improved by comparing it to the experience of other (African) countries, since it is always illuminating to look at institutions in comparable situations. By looking at other countries with similar problems, one can learn from examining how they have dealt with them. One way is to learn by observing the outcomes of alternative solutions used elsewhere, nonetheless, bearing in mind that there may not be a simple solution to our local problems that can be borrowed from somewhere else.

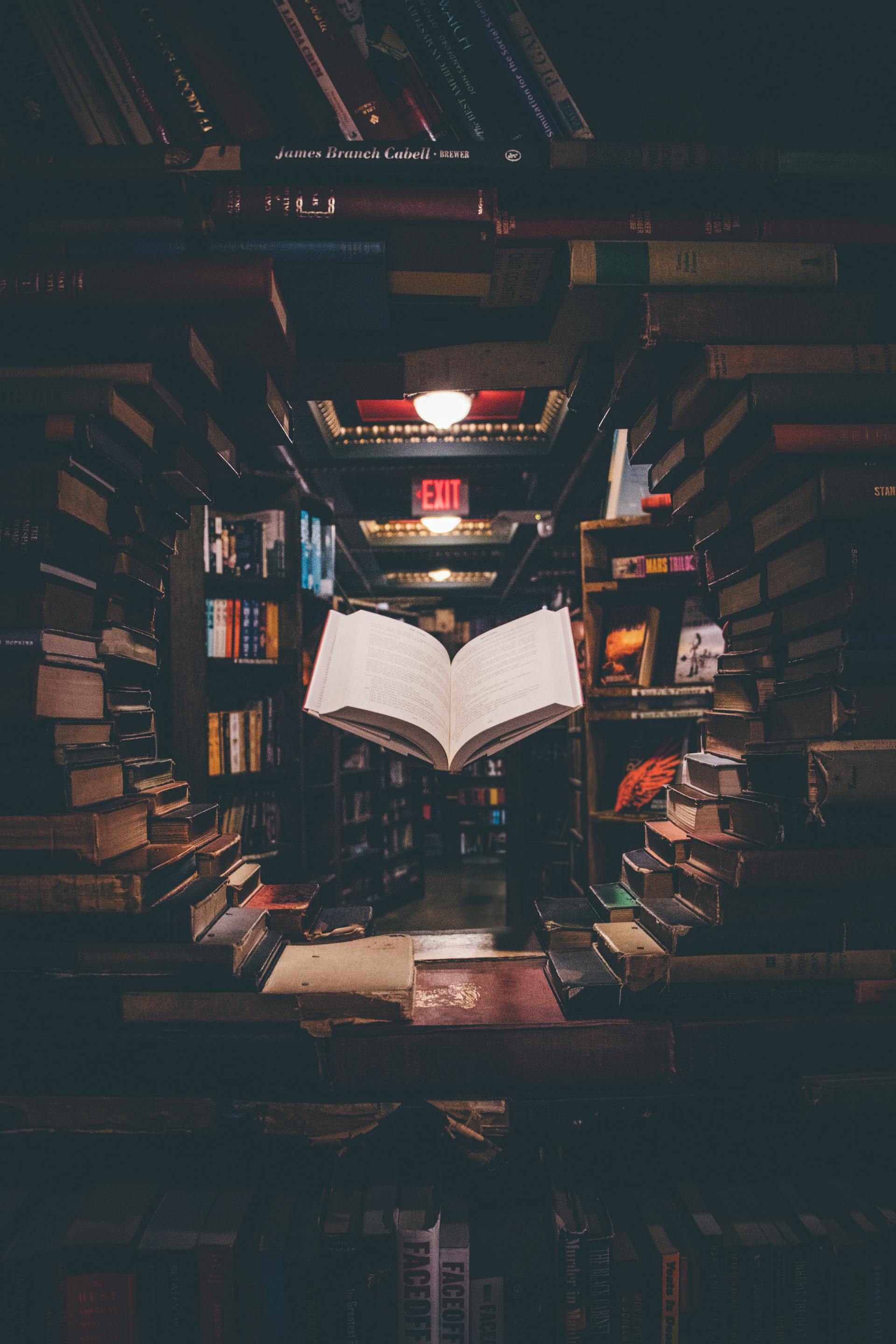

This is a great opportunity for the huge number of invaluable documents that are kept in the shelves and drawers of the various tax administrations in Africa!

What and Who can upload

The platform welcomes uploads of any Research Papers, Articles, Essays, Reports, Policy Briefs, Newsletters, Bulletins, Fact Sheets, Summaries, etc. in PDF format that content are good practices, experiences and knowledge in tax matters.

Tax administrations who upload any publication should make sure the documents meet the following standards and best practices:

- Only one user or "focal point" from the Tax Administration is able to upload the publications.

- The file type may be .PDF, according to the nature and document content. No individual research will be accepted.

- The maximum allowable size per document may not be more than 2MB.

- File sizes exceeding 2MB will not be accepted.

- You can upload up to 3 files separately, (possibility of uploading documents in different days before final submission).

- Please upload documents not older than 3 years.

- Please upload documents in the right category where it best fit. Please find below a list of possible categories:

- Tax Administration

- Tax policy: tax incentives, informal sector, VAT regimes, transfer pricing, exchange of information and other policy related issues.

- Tax Legislation.

- International Taxation.

- Others.

- Any document submission requires ATAF's approval based on Submission Criteria before it is published.

- After approval, documents will be published on the platform and the Tax Administration will be notified.

- Should there be a need of amendments (clarification) in the document before its approval, the "focal point" will be notified. The "focal point" will be able to see the document and work on it, but nobody else will have access to it until it is approved and published.

- The "focal point" can replace an existing approved document with a revised version, however, it will be subject again to all submission criteria.

- When uploading a new version of a document, (there must be a NOTE about what changed in this version history record).

- When uploading a document, the "focal point" must be aware of file's name length.

Disclaimer

The views expressed in

this Platform are those of the author(s) and do not necessarily represent the

views of the African Tax Administration Forum (ATAF). The publications herein

are the contributions of the African tax administrations and are published to

share good practices, experiences and knowledge in tax matters, as well as to

elicit comments and to further debate.

Click

here

to register